Joseph I. Giarrusso

Dear Neighbors,

My office continues to receive calls and emails from New Orleanians concerned with their assessments. Now that we are past the deadline for formal assessment appeals, I want to be sure people know what comes next. Decisions at the Board of Review, at the City Council and various board and commissions, and the ballot box will all affect the 2020 tax bills. Included below are several slides from my Fall 2019 Tax Considerations Presentation.

Board of Review

The New Orleans City Council also acts as the Board of Review (BOR) and has the authority to change only those assessments formally appealed. If you did not appeal or if you accepted the assessor's informal reduction, you are likely ineligible for an appeal to the BOR. The BOR contracts with professionals to hold hearings with all property owners who file appeals. Once those hearings are complete, the BOR will receive a list of suggested assessments, including recommended adjustments based on evidence presented at these hearings, and make independent judgments on property values at a public meeting.

Property owners appealing their assessment who disagree with the BOR decision can appeal to the Louisiana Tax Commission. The Council website contains helpful information on this process, including timelines and frequently asked questions, here.

Taxing Entities

Only about a third of the millage rates are controlled by the New Orleans City Council. The chart below shows which rates are determined by the City Council, as opposed to others:

Millage Roll Back/Roll Forward

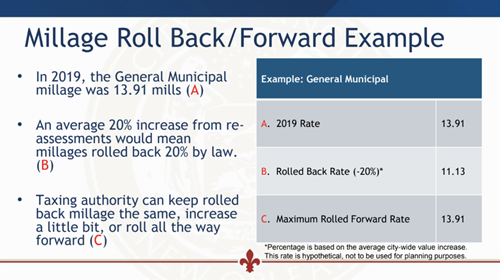

Remember one factor affecting your property tax is the assessment. The other factor contributing to your tax bill is the millage amount. In 2019, most New Orleanians paid about 150 mills. By law, millage rates must be reduced to ensure that revenue raised after a quadrennial reassessment is equal to the amount raised the previous year. That is referred to as a "roll back" and the amount of the millages are decreased to reach revenue neutral status. Once those millage rates are "rolled back," however, the separate tax entities can "roll forward" their different millage rates up to the prior year's amount. See below for an example of a hypothetical "roll back" and "roll forward" of a City millage:

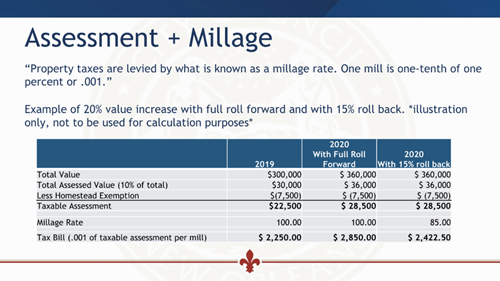

If your property value increases more than the city-wide average, your taxes likely will increase even with a full "roll back." See the below hypothetical for round numbers:

I encourage residents to contact all elected and appointed representatives regarding the impact of a possible roll forward. Click here to view available email addresses or websites.

November Ballot Initiatives

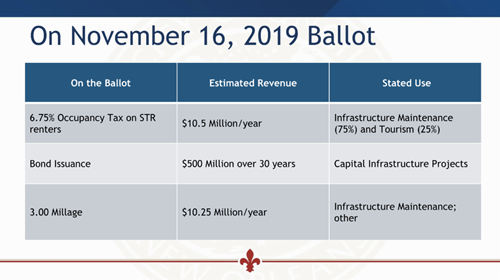

The last piece of this is several measures that will be on your ballot in November. The first is an occupancy tax on tourists who stay in Short Term Rentals and brings the tax rate in line with hotel taxes. This revenue would be split between infrastructure maintenance (75%) and tourism (25%). The second is to approve a bond issuance for capital infrastructure projects, which are projects that have a life span of more than 10 years. Those projects could include streets, building upgrades, and affordable housing. The final measure is an additional 3.00 mills to be added to 2020 property tax bills and for 20 years thereafter. This revenue would be spent on projects with a life span of less than 10 years: infrastructure projects, technological upgrades, police and fire vehicles, etc.

I understand the concern and frustration of many and hope that the above information will help with the decision-making process. If you have additional questions, please feel free to contact my office at (504) 658-1010 or Joseph.Giarrusso@nola.gov.

Sincerely,

Joe

###

Media Contact:

Katie Baudouin

Councilmember Joseph I. Giarrusso III

kmbaudouin@nola.gov

(504) 658-1010